The difference between PROFIT and CASHFLOW

This is a long one but very important and interesting……………………..

Question from a customer:

“I have just received a copy of the accounts to which show a better profit than the year before, but the bank overdraft has increased. Surely if the business is profitable, the overdraft should be reducing?”

Vicky Anderson provided the following response:

“This is one of the most common misconceptions regarding accounts. There are a number of reasons why accounting profit and cash generated are not the same. This has always been the case for growing businesses, and is a particular challenge for many businesses at present due to increased costs and previous increase in loans and financing. I will illustrate this issue with a few examples:

1. If the value of stock on hand is higher at the end of the year than at the beginning, this will increase your profit without generating any cash. The increase in costs seen will mean that the value of your produce or sold items will be much higher than last year. The result is that even profitable businesses may need to have higher overdraft facilities this year to finance these higher costs.

2. The cost of new equipment and buildings are not written off in your accounts in the year of purchase, but are depreciated over their useful economic life. Few businesses have the ability to purchase new machinery out of annual profits, and it makes sense to spread the cost over the working life of the machine. Thus a bank loan or hire purchase agreement which spreads the cost over the same period that the machine will generate income for the business makes more sense. So you have to make the profit to cover the cost of the finance for the machine as this is taken out after the profit and adds to the cashflow deficit.

3. Interest payments on loans are an expense in your profit and loss account, but not capital repayments. Cashflow problems can arise if there are not sufficient profits in the year to cover the capital repayments on bank loans. When taking out a long-term loan to purchase land or buildings, it is important to spread the repayments over a realistic period of time. If you choose too short a period, there is a risk that in a year when profits are low or working capital increases, that there is insufficient cash when the loan repayments become due. Again loan payments are after profit so you have to make enough profit to pay off your loans. Ie if your loan repayments in anyone year are £50,000 you have to make at least £50,000 to pay those loans or it will impact on your cashflow and increase overdraft.

4. There is a further problem which mainly impacts businesses operating through a partnership. Money taken out of the business to pay for living expenses, do not go through the profit and loss account, but are shown as drawings in the capital account. This means that the profit each year as a minimum needs to be higher than the level of personal drawings taken out each year by the partners in the business. The position is slightly different if your business operates via a company, where the cost of salaries paid to the working directors is shown in the profit and loss account.

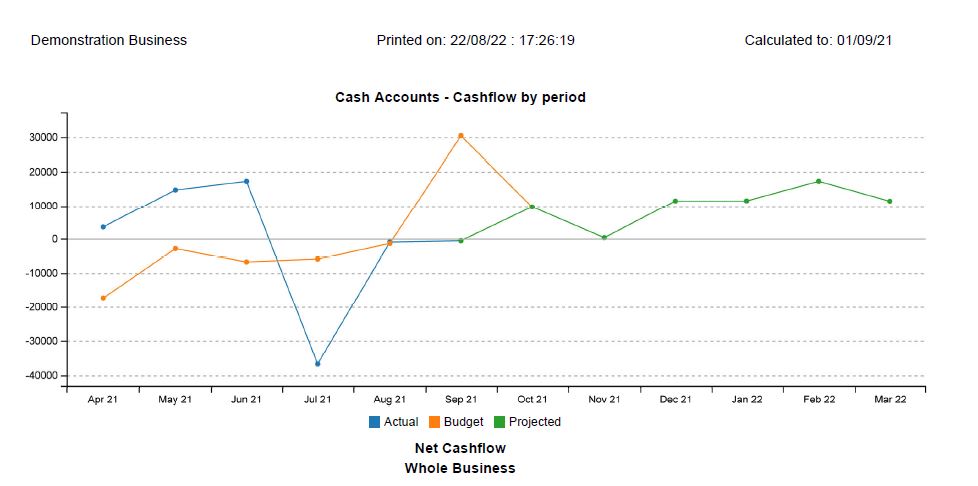

In summary, it is crucial to understand what cash your business will generate and what is required to service borrowings and pay bills over the coming year.”