Don’t Panic! Things may not be as bad as you think!

Chancellor Rachel Reeves, announced her first budget on 30 October. In it she announced some major changes for UK employers. There is a wealth of hype in the media and social media regarding these changes. Much of this has caused alarm amongst employers.

However, at Vicky Anderson we have taken time and drilled down into the figures and we feel that things may not be as bad as you think. Read on for the figures…

Calculator for change in employers National Insurance increase in 2025

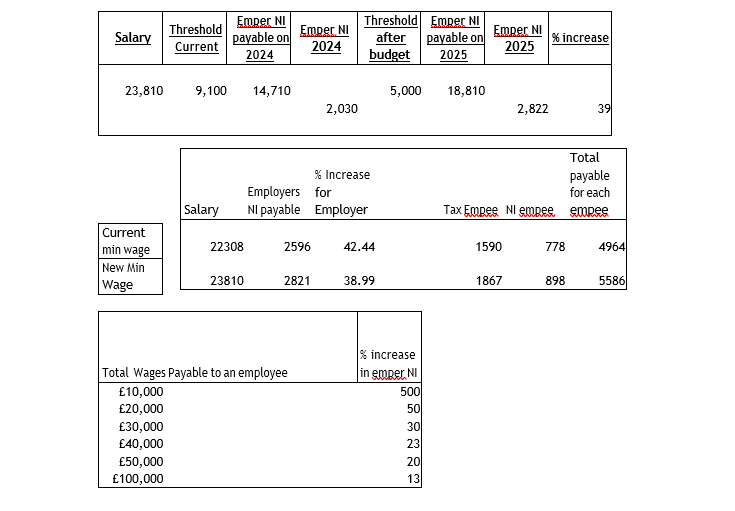

Employers National Insurance Costs 2025 onwards

2025 £10,500 Employer Allowance

This covers all Employee Tax, Employee NI and Employer NI that is paid monthly to HMRC.

For 2 employees on minimum wage

So the NEW cost gives you 2 employees on minimum wage for a cost of £672

Currently in 2024 the OLD COST for 2 employees on national minimum wage will cost £3382 as employer allowance is £5000.

If you have 5 employees

The new cost will be £8460

Whilst the old cost would have been £11845.

If you employ 10 employees

Under the Chancellor’s new rules, the new cost will be £23420.

Whilst the old cost would have been £25950.

To summarise

So there will be Employer National Insurance to pay for more workers with lower pay, which will bring in more payments for the Government… but if all workers are paid over the minimum wage and full time there will be less for you, the employer to pay.

If you are a larger employer with a PAYE bill of over £100,000 per annum, you will now be able to claim the £10,500 which will help with the large increase in % terms, but this may not be the case for those with lots of low paid workers.